Contact Us Now for Trusted Debt Consultancy Services in Singapore

Contact Us Now for Trusted Debt Consultancy Services in Singapore

Blog Article

Open the Advantages of Engaging Debt Specialist Provider to Navigate Your Path Towards Debt Alleviation and Financial Liberty

Involving the solutions of a debt expert can be a pivotal action in your trip in the direction of achieving financial debt alleviation and economic stability. The concern continues to be: what details benefits can a financial debt specialist bring to your financial circumstance, and just how can you determine the ideal companion in this undertaking?

Recognizing Debt Expert Services

Financial obligation specialist solutions supply specialized advice for individuals grappling with economic obstacles. By evaluating your earnings, financial debts, and expenses, a financial debt expert can aid you determine the root triggers of your economic distress, enabling for a more exact method to resolution.

Financial debt specialists normally utilize a multi-faceted strategy, which may include budgeting aid, settlement with creditors, and the growth of a calculated payment plan. They function as middlemans between you and your financial institutions, leveraging their experience to bargain a lot more desirable terms, such as decreased passion prices or extended repayment timelines.

Furthermore, financial debt professionals are geared up with current expertise of appropriate regulations and regulations, guaranteeing that you are educated of your civil liberties and alternatives. This professional advice not just alleviates the psychological concern related to financial obligation however likewise empowers you with the devices required to restore control of your financial future. Inevitably, engaging with financial obligation consultant solutions can bring about a much more enlightened and structured course towards monetary security.

Secret Advantages of Expert Guidance

Involving with financial obligation professional services provides numerous advantages that can dramatically boost your monetary scenario. One of the key benefits is the know-how that experts give the table. Their substantial understanding of financial debt management approaches permits them to customize services that fit your distinct conditions, guaranteeing an extra efficient method to achieving economic stability.

Additionally, debt experts often provide arrangement help with creditors. Their experience can cause much more beneficial terms, such as decreased rate of interest or cleared up financial debts, which might not be achievable via straight negotiation. This can cause substantial economic alleviation.

In addition, consultants supply an organized prepare for payment, helping you focus on financial obligations and assign sources successfully. This not only simplifies the settlement process however also fosters a sense of liability and progression.

Ultimately, the combination of expert assistance, arrangement skills, structured repayment plans, and psychological support placements financial debt specialists as useful allies in the search of financial obligation relief and economic freedom.

How to Pick the Right Specialist

When picking the appropriate financial debt consultant, what key variables should you think about to make certain a positive result? First, evaluate the consultant's credentials and experience. debt consultant services singapore. Look for accreditations from acknowledged companies, as these show a level of professionalism and reliability and knowledge in the red monitoring

Following, take into consideration the specialist's credibility. Study on the internet evaluations, reviews, and ratings to evaluate previous clients' contentment. A solid track record of effective financial obligation resolution is important.

Additionally, evaluate the consultant's technique to financial debt administration. An excellent consultant ought to offer customized services customized to your distinct monetary circumstance instead of a one-size-fits-all solution - debt consultant services singapore. Openness in their charges and procedures is crucial; guarantee you recognize the expenses entailed before committing

Communication is another crucial variable. Pick a specialist who is approachable and ready to answer your concerns, as a solid working relationship can improve your experience.

Common Debt Alleviation Techniques

While numerous debt relief strategies exist, picking the right one depends upon individual economic circumstances and goals. Several of the most typical methods include financial obligation consolidation, debt management plans, and debt negotiation.

Financial debt debt consolidation involves incorporating numerous debts right into a single official statement loan with a reduced rate of interest. This approach simplifies settlements and can lower monthly obligations, making it less complicated for people to regain control of their financial resources.

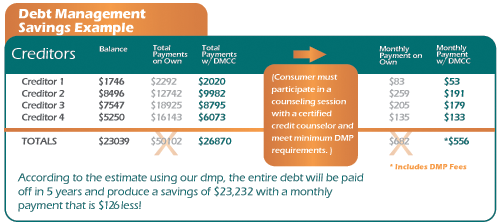

Financial debt monitoring plans (DMPs) are designed by credit rating counseling firms. They negotiate with creditors to reduced rates of interest and create an organized repayment strategy. This alternative allows people to pay off debts over a set duration while taking advantage of specialist advice.

Debt negotiation requires negotiating directly with financial institutions to clear up financial debts for less than the complete amount owed. While this method can give immediate relief, it may impact credit history and usually includes a lump-sum settlement.

Lastly, personal bankruptcy is a lawful option that can offer alleviation from frustrating financial debts. However, it has lasting financial effects and need to be thought about as a last hotel.

Picking the appropriate method needs cautious evaluation of one's monetary situation, guaranteeing a tailored strategy to achieving long-lasting security.

Actions Towards Financial Freedom

Next, establish a reasonable spending plan that prioritizes basics and click for more info fosters savings. This budget plan needs to consist of stipulations for financial obligation repayment, enabling you to allot excess funds successfully. Complying with a spending plan aids cultivate disciplined investing practices.

When a budget plan remains in area, take into consideration involving a financial debt expert. These professionals supply customized techniques for managing and lowering debt, offering understandings that can accelerate your journey towards economic freedom. They may advise alternatives such as financial obligation combination or negotiation with creditors.

In addition, focus on building an emergency fund, which can stop future financial pressure and give comfort. Lastly, buy economic proficiency via sources or workshops, enabling informed decision-making. With each other, these actions develop an organized method to accomplishing economic flexibility, changing ambitions right into fact. With commitment and informed actions, the prospect of a debt-free future is accessible.

Verdict

Engaging financial debt consultant services provides a strategic strategy to achieving debt alleviation and financial freedom. Eventually, the expertise of debt consultants dramatically improves the likelihood of navigating the complexities of debt management effectively, leading to a more secure monetary future.

Involving the solutions of a debt specialist can be an essential action in your journey in the direction of attaining financial debt alleviation and financial security. Debt specialist services supply specialized advice important site for individuals grappling with financial challenges. By analyzing your earnings, debts, and expenditures, a financial obligation consultant can assist you determine the root triggers of your monetary distress, allowing for an extra exact approach to resolution.

Engaging financial obligation professional solutions uses a strategic method to attaining financial obligation relief and monetary liberty. Inevitably, the experience of financial debt specialists dramatically improves the possibility of browsing the complexities of financial debt monitoring successfully, leading to an extra safe economic future.

Report this page